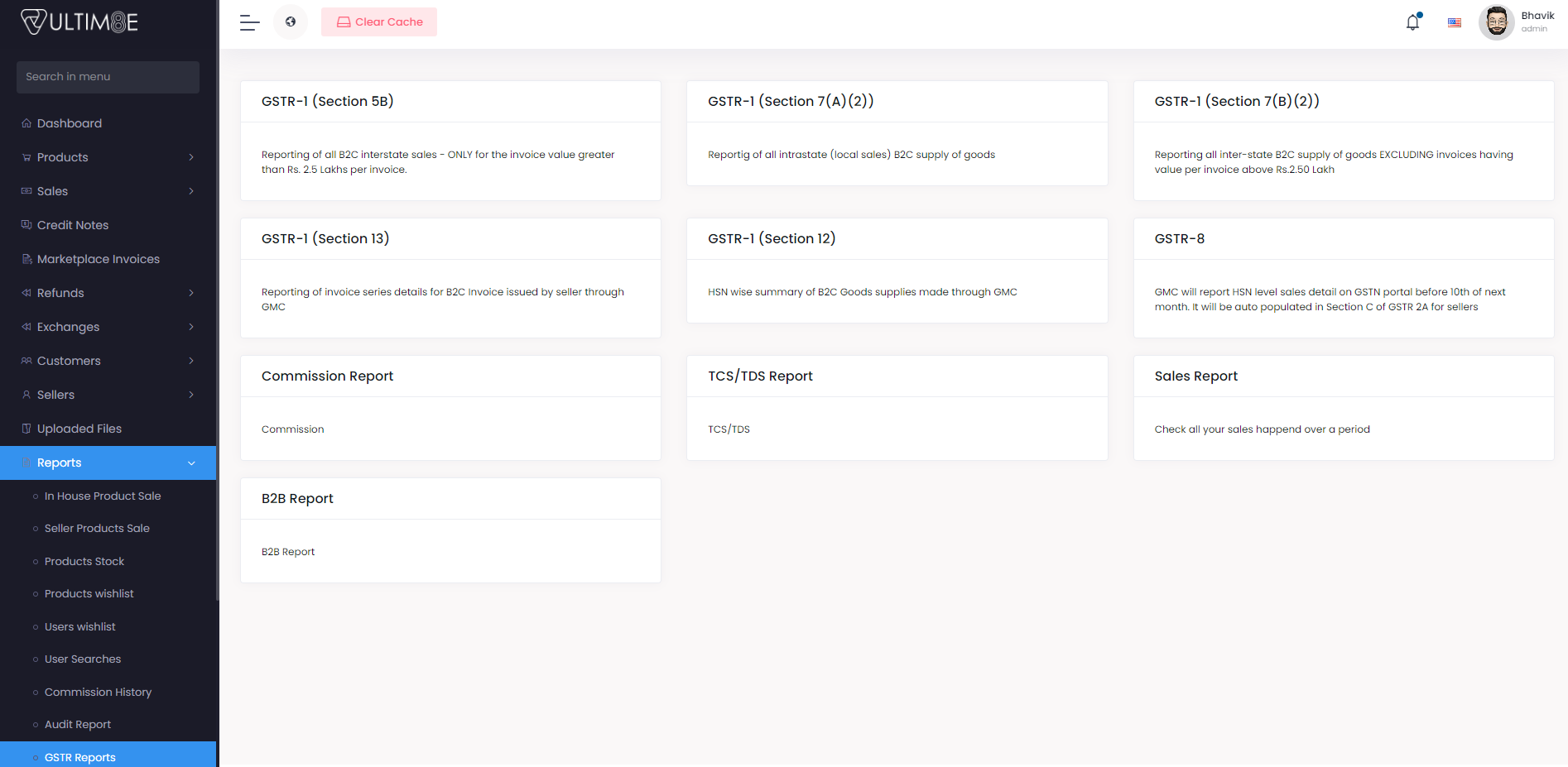

GSRT Reports

ShopOne provides you an easy way to get your GST reports.

Go to admin panel -> Reports -> GSTR reports -> click on report you want to download -> select month & year -> click on download

- GSTR - 1 (Section 5B)

- GSTR - 1 (Section 7(A)(2))

- GSTR - 1 (Section 7(B)(2))

- GSTR - 1 (Section 13)

- GSTR - 1 (Section 12)

- GSTR - 8

- Commission Report

- TCS/TDS Report

- Sales Report

- B2B Report

GSTR - 1 (Section 5B)

GSTR - 1 (Section 7(A)(2))

- Shows reports of B2C sale with CGST & SGST (Intrastate transactions)

- GSTIN, Gross Taxable Value Rs.(Total of taxable amount), Taxable Sales Return Value Rs.(Total of return sales amount), Aggregate Taxable Value Rs.(Total Sales - total return sales), CGST %, CGST Amount Rs.(Total of CGST amount), SGST/UT %, SGST /UT Amount Rs.(Total of SGST amount), Cess %, CESS Amount Rs.(Total CESS amount)

GSTR - 1 (Section 7(B)(2))

- Shows reports of B2C sale with IGST (Interstate transactions) state wise.

- GSTIN, Gross Taxable Value Rs.(Total of taxable amount), Taxable Sales Return Value Rs.(Total of return sales amount), Aggregate Taxable Value Rs.(Total Sales - total return sales), IGST %, IGST Amount Rs.(Total of IGST amount), Cess %, CESS Amount Rs.(Total CESS amount)

GSTR - 1 (Section 13)

- Shows reporting of series details.

- GSTIN, Invoice Series From, Invoice Series To, Total Number of Invoices, Cancelled if any, Net invoices Issued

GSTR - 1 (Section 12)

- Shows reporting of total sales (HSN wise)

- GSTIN, HSN Number, Total Quantity in Nos., Total Value Rs.(Total sales amount), Total Taxable Value Rs.(Total base amount), IGST Amount Rs., CGST Amount Rs., SGST Amount Rs., Cess Rs.

GSTR - 8

- Shows reporting of total sales

- GSTIN, Seller ID issued by GMC, GSTIN of GMC, Gross Taxable Value Rs., Taxable Sales Return Value Rs., Net Taxable Value, TCS %, TCS IGST amount Rs., TCS CGST amount Rs., TCS SGST amount Rs., IGST Amount Rs., CGST Amount Rs., SGST Amount Rs., Invoice Qty (Net)

Commission Report

- Shows reporting of total commission

TCS/TDS Report

- Shows reporting TCS & TDS of total sale

- GSTIN, Name (shop name), B2B Sale Taxable, B2C Sale Taxable, TCS collected-CGST, TCS collected-SGST, TCS collected-IGST, TDS

Sales Report

- Shows reporting of total sales

- Party Code, GST No, Party Name, Invoice No., Order Type, Date of Order, Invoice Date, Delivery Date, Buyer State, Buyer Address, Buyer Registration Status, Buyer GST No, Item Name, HSN/SAC, QTY, GST Rate, Taxable Value, IGST, CGST, SGST, TCS, TDS, Commission Taxable Vale, GST on Commission, Net Payable

B2B Report

- Shows reporting of total B2B sales

- GSTIN/UIN of Recipient, Receiver Name, Invoice Number, Invoice date, Invoice Value, Place Of Supply, Reverse Charge, Applicable % of Tax Rate,Invoice Type, E-Commerce GSTIN, Rate, Taxable Value, Cess Amount